Understanding Google Ads & Meta Ads Billing in Australia: A Complete Guide for Businesses

Running paid ads on Google or Meta (Facebook and Instagram) can deliver incredible results for Australian businesses, but the billing system often catches people off guard. You might see multiple monthly charges, amounts that seem too small, or payment dates that don’t follow a traditional monthly cycle.

In this guide, we’ll explain how billing works for both platforms, why charges vary, whether GST applies, and how to get tax invoices for your records.

Google Ads Billing for Australian Advertisers

How often will I get charged?

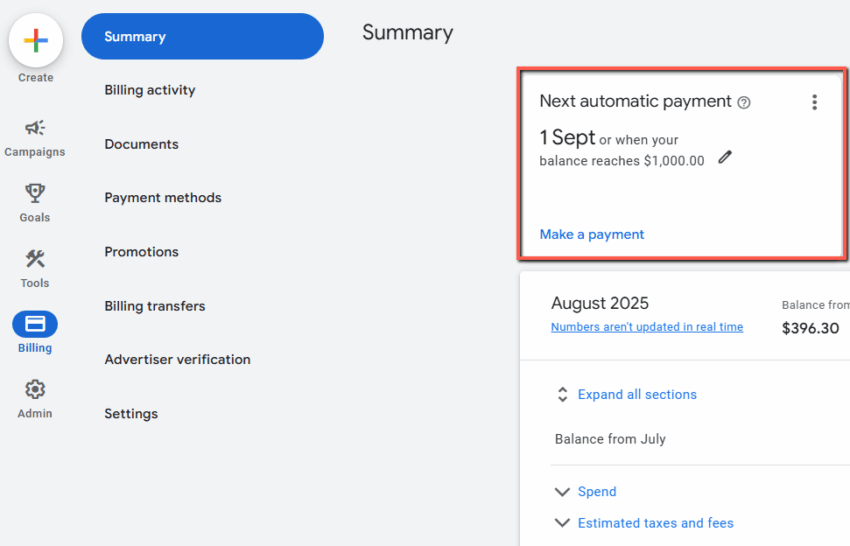

In Australia, Google Ads usually operates on automatic payments in AUD. You’re billed when:

- Your account hits a billing threshold (e.g. $500, $1,000, $2,000), or

- 30 days have passed since your last payment, whichever comes first.

Example:

If your threshold is $500 and you spend $1,500 in 20 days, Google will bill you three times in that period.

This means a busy month with high ad activity can result in more frequent charges, even if your daily budget has remained the same.

Does Google Ads charge GST in Australia?

Yes. Google Australia Pty Ltd is registered for GST, and all Google Ads invoices for Australian advertisers include 10% GST. The amount charged to your credit card already includes GST, so you can claim it if you’re registered for GST.

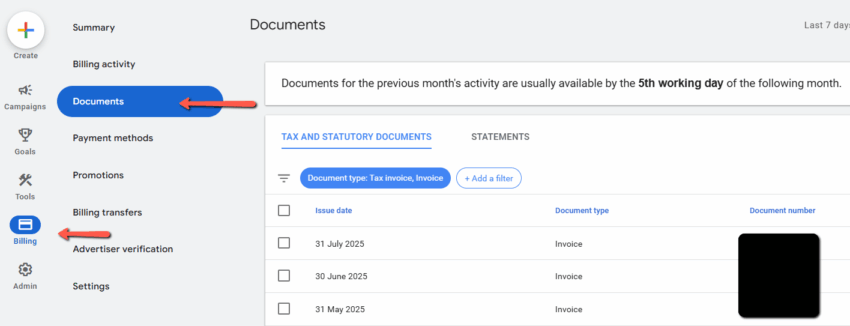

How do I get Google Ads invoices for tax purposes?

Google issues tax invoices that meet Australian Tax Office (ATO) requirements. You can:

- Log in to Google Ads

- Click the Billing icon.

- Under Billing, select Documents.

- Download your invoices in PDF format (each will list your ABN, GST amount, and Google Australia’s ABN)

You’ll get a single consolidated monthly invoice for the entire month.

Can I pay monthly instead of automatic debits?

Yes, but only if your account is eligible for monthly invoicing. In Australia, this generally requires:

- A history of on-time payments

- A minimum monthly ad spend (usually several thousand dollars)

- An approved credit application with Google

Monthly invoicing allows you to receive a single GST-compliant invoice at the end of each month and pay via bank transfer.

Why did I get charged more often this month?

Two main reasons:

- Your ads performed better — more clicks means you hit your threshold sooner.

- You increased your daily budget — this naturally speeds up how quickly you reach your threshold.

Meta Ads Billing for Australian Advertisers

How often will I get charged?

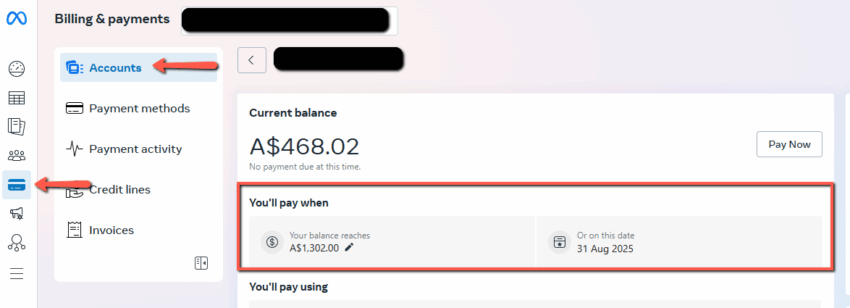

Meta Ads (Facebook and Instagram) use a similar threshold model:

- You’re billed when you hit your billing threshold (e.g. $40, $250, $750), or

- At the end of your monthly billing cycle.

Thresholds start small for new accounts and increase over time as you make successful payments. Meta has an edit function to change the balance limit, but unfortunately, we have seen that it doesn’t work and sticks to what Meta decides.

Does Meta Ads charge GST in Australia?

Yes. Since July 2017, Meta Platforms has charged 10% GST on advertising services sold to Australian businesses. GST is included in your total charge and is shown on your tax invoice.

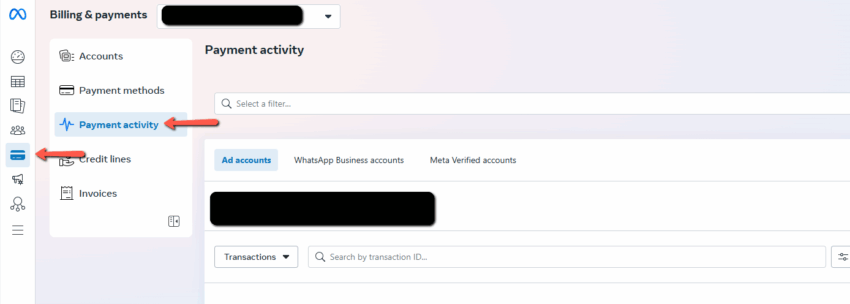

How do I get Meta Ads invoices for tax purposes?

Meta invoices are GST-compliant for Australian businesses and can be downloaded from Ads Manager:

- Go to Billing in Ads Manager

- Select the Payment Activity.

- Download invoices as PDFs (these will include your ABN if it’s been added to your account, along with GST details)

Tip: If you haven’t entered your ABN in your Business Manager settings, update it so your invoices show correct details for tax claims.

Why is Meta charging small amounts?

It’s normal for Meta to bill smaller amounts, especially for new advertisers. This protects against payment issues and fraud. As your billing threshold increases, charges become less frequent.

My bank flagged suspicious activity — is it really Meta?

In Australia, Meta transactions may appear as:

- FACEBK

- Facebook Ads

- Meta Platforms Ireland

Multiple small charges on the same day can look suspicious to banks. Match the charges to your Ads Manager billing history to confirm.

How to Stay on Top of Your Ad Billing

- Set budget alerts in Google Ads and Meta Ads so you’re notified when spend approaches your limit.

- Download your invoices monthly for GST reporting — both platforms provide Australian tax invoices.

- Review your payment method regularly to avoid campaigns pausing due to card expiry.

- Ask your agency about pacing rules to spread spend evenly across the month.

- Know your threshold so you can predict charges and avoid surprises.

Taking the Guesswork Out of Ad Payments

Once you understand the threshold system and GST rules, Google and Meta billing become less mysterious. Most unexpected charges are just automated thresholds being reached, not overspending.

If something doesn’t look right, we can trace and explain every charge quickly and in plain English so you can focus on running your campaigns and not worry about billing.

Billing FAQs

Can I pay for Google Ads or Meta Ads using a bank transfer in Australia?

Yes, but only if you’re on monthly invoicing. Both Google Ads and Meta Ads allow EFT payments for eligible accounts. Most advertisers start on automatic card payments and must apply for monthly invoicing to switch to bank transfers.

What ABN details should I add to my ad account for tax invoices?

You should add your registered business name and ABN exactly as they appear on your Australian Business Register (ABR). This ensures your tax invoices from Google and Meta are valid for GST claims and ATO compliance.

Do Google Ads and Meta Ads keep a history of old invoices?

Yes. Both platforms allow you to access and download past invoices for several years. This is especially helpful if you need to review spending or lodge late BAS statements. In Google Ads, older invoices remain in the “Documents” section. In Meta Ads, you can select historical date ranges in the Billing section.

Can I get one invoice for multiple ad accounts?

If your accounts are consolidated under a single billing arrangement, Google can offer “Manager account billing” for linked accounts, while Meta provides “Business Manager payment settings” to combine billing. This is ideal for businesses running multiple brands or locations.

Will my ad spend show up in AUD or USD?

If your billing country is Australia, all charges will appear in AUD and include GST. If you accidentally set your account to another country or currency during setup, you can’t change it without creating a new account.

Can I claim back GST on my ad spend if my business isn’t registered?

No. Only GST-registered Australian businesses can claim back GST on ad spend. You’ll still see GST on your invoice if you’re not registered, but you can’t claim it as an input tax credit.

Do I get a tax invoice if I pay with PayPal?

Yes. The payment method (credit card, debit card, PayPal) doesn’t affect your invoice. Your Google or Meta account will still generate the same GST-compliant invoice.