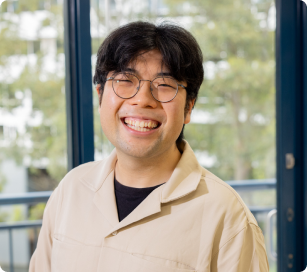

How We Launched a New Fintech Brand in Just 6 Weeks

When Australia’s small business finance market needed a fresh new player, SME Money stepped in with a bold vision: remove the friction from funding. But in a crowded space where trust is everything, building credibility and conversions starts with one thing: the website.

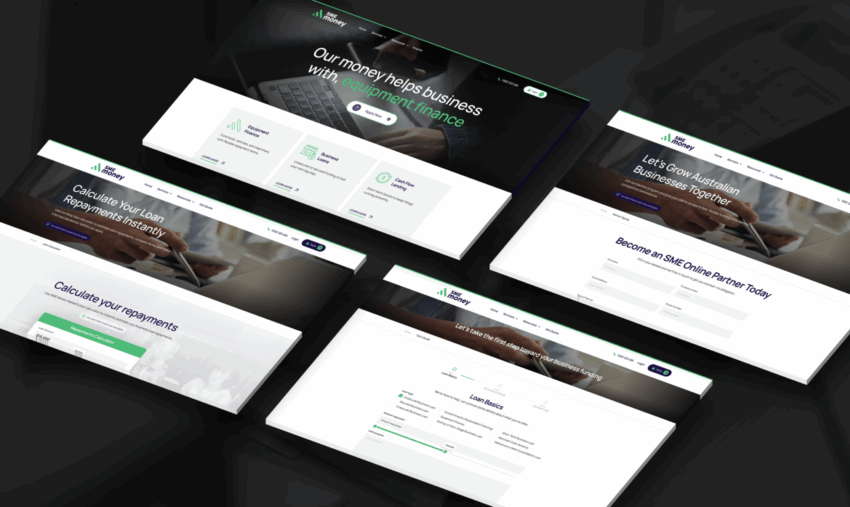

Click Click Media partnered with SME Money from day zero to design and develop a complete digital experience, launching the brand’s entire online presence in just six weeks. From UX and UI to agile development and a custom-built loan calculator, this was more than a website project. It was the digital birth of a business.

A Brand-New Business, Built on Digital

SME Money didn’t come to us with an outdated website. They came with no website at all.

As a new player in the small business lending space, they needed to go live fast, but without sacrificing polish, performance, or trust. In its initial stages, he entire brand would be experienced through the website. That meant design, messaging, functionality, and user experience all had to work in harmony, right from the first visit.

The Brief: Fast, Functional, and Finance-Ready

SME Money’s core value proposition is speed and simplicity. Business owners can apply for funding online, get decisions fast, and unlock opportunities within 24 hours. The website needed to echo that same experience. It needed to be clean, modern, and frictionless.

We worked closely with SME Money’s leadership to define the key priorities:

- Design a brand-forward digital experience that builds instant trust

- Streamline the user journey for fast loan applications

- Build a lightweight, high-performance platform ready for scale

- Develop an interactive loan repayment calculator to support decision-making

We resolved to deliver the entire project, from concept to launch, in just six weeks

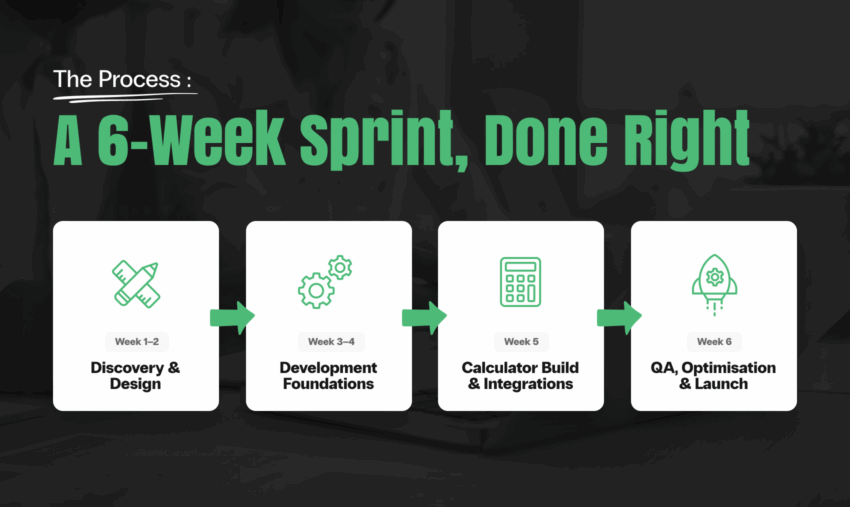

The Process: A 6-Week Sprint, Done Right

We used an agile delivery framework with clearly defined sprints, daily check-ins, and rapid prototyping to keep momentum strong and timelines sharp.

Week 1–2: Discovery & Design

We began with a rapid discovery phase to extract the essentials: What does SME Money stand for? Who are they here to serve? What kind of online experience will instantly build trust with time-poor business owners?

Through stakeholder workshops, we shaped a clear content strategy and information architecture that prioritised action, from homepage to loan application. SME Money’s promise of “quick, easy funding” became a guiding principle in every UX decision.

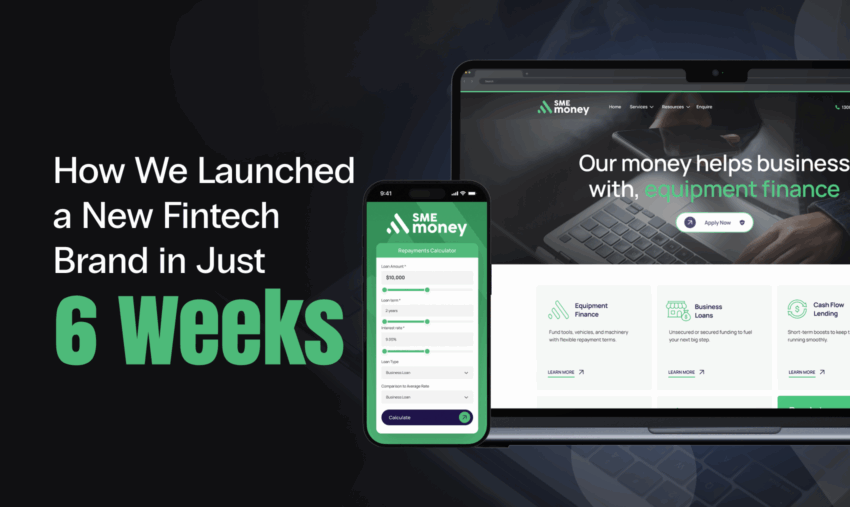

We then moved into visual design. From day one, it was clear that this site needed to feel fresh and professional, without falling into the trap of looking like every other corporate finance brand. No stocky clichés. No cold, impersonal styling.

Our design team crafted:

- A clean, approachable visual identity with calming colour palettes

- Modern, legible typography optimised for web accessibility

- A modular UI system with reusable components for scale

Finalised wireframes and high-fidelity mockups were handed off quickly to ensure development could begin in parallel.

Week 3–4: Development Foundations

With core design elements locked in, our development team began laying the groundwork. This meant building the structural backbone of the site with a component-based development approach, allowing flexibility, scalability, and consistency.

We rolled out:

- Responsive grid layouts and global navigation

- Reusable sections for hero banners, testimonials, FAQs, and forms

- Fully mobile-optimised templates from the start (no retrofitting required)

- High-speed architecture with lazy-loading, optimised media, and semantic markup

We also used this phase to prototype key journeys, such as the loan application, quoting, and partnership funnels, ensuring both UX and functionality aligned before layering in more complex features.

Week 5: Calculator Build & Integrations

One of the most important pieces of functionality for SME Money was the interactive loan repayment calculator, a tool designed to empower users with repayment insights before they even applied.

We custom-built the calculator and integrated it with dynamic loan logic, allowing users to:

- Adjust loan amount and term with real-time repayments displayed instantly

- See their repayment frequency clearly (monthly, weekly, etc.)

- Navigate the calculator seamlessly across devices

Behind the scenes, we worked closely with SME Money’s compliance team to ensure the estimates aligned with real lending criteria. We also stress-tested the calculator to prevent any user frustration from lag or glitches.

In parallel, we implemented CRM-integrated forms to support lead generation and nurture workflows.

Week 6: QA, Optimisation & Launch

The final week was all about polish and performance. We ran a full QA sweep across major browsers, screen sizes, and devices, fixing minor layout issues, testing functionality, and ensuring the site met WCAG accessibility standards.

We then:

- Compressed and optimised all assets for faster load times

- Tested form submissions, email triggers, and calculator behaviour

- Integrated SSL and cloud CDN hosting for security and speed

- Set up redirects, favicons, open graph tags, and metadata for a complete, professional finish

By the end of the sixth week, SME Money’s site was live, stable, and conversion-ready, built on a framework that could grow as the business scaled.

Trust-Building by Design

The visual identity of SME Money strikes a careful balance between professional and personable. Clean lines, ample whitespace, and human-centric imagery reinforce transparency, while micro-animations and scroll-based transitions add polish without distraction.

We used a modular design system to unify layout and style across the site. Key features include:

- Instant trust cues like testimonials and lender logos

- Clear CTAs that guide users to “Apply Now” or learn more

- Soft gradients and blue tones to create a calming, confident digital environment

Mobile-first approach, ensuring accessibility for time-poor business owners applying from their phone

The Interactive Edge: Loan Repayment Calculator

At the heart of the site is the loan repayment calculator, a fully interactive tool that allows users to explore repayment terms before filling out a form.

This wasn’t just about adding utility. It was about lowering the barrier to entry. By giving users an instant sense of control and clarity, we helped increase engagement and time on site, turning cold traffic into warm leads.

The calculator is fully responsive and optimised for mobile, making it easy for business owners to crunch numbers on the go.

The Results: Launch, Lead Flow, and Lift-Off

SME Money launched with a clean, high-performance site that immediately began generating qualified traffic and leads. More importantly, it gave the business a digital identity that matched the ambition of its mission: funding small businesses, fast.

In six weeks, we didn’t just build a website. We helped SME Money launch a brand, earn user trust, and create a digital experience that reflects their promise to small businesses: fast, friendly funding when it matters most.

Got a Big Vision and a Tight Deadline?

Whether you’re launching a brand from scratch or rebuilding your digital presence to match your ambition, we’re here to make it happen. At Click Click Media, we combine smart design, agile development, and deep marketing expertise to bring high-performance websites to life. Fast.

Need to go live in weeks, not months?

Let’s talk about what we can build together. Get in touch with our team today